Saving for Health Care is Important

Health is wealth is one life wisdom you hear often. Investing in your pre-emptive good health and securing health insurance for near and long-term health uncertainty is essential to overall well-being—one of your top 5 expenses during your high-earning years and retirement—health care. The benefits of health savings accounts helps your health care and retirement planning and supercharges your pathway to financial freedom.

The Government ‘Wants’ You to Have An HSA

Healthcare costs for Americans are incredibly high compared to other wealthy countries. If American households cannot meet their health and childcare obligations now and during retirement, the Government carries a large part of the bill.

Health and Medicare are the federal government’s top five growing spending obligations; they would instead share more or pass along this expense with you. Congress passes tax laws through the Internal Revenue Code (IRC), creating tools to incentivize individuals to fund and participate in their health journey. The HSA is the best since sliced bread–meaning the account is triple tax-advantaged.

Tax Deductible

When you make contributions to your account, they are tax-deductible, reducing your annual federal taxable income. Finding high-income earners ways to reduce taxable yearly income is especially helpful for tax planning.

Making the HSA tax deduction more valuable to many is that the contribution is an “above-the-line” deduction allowing you to use it even if you don’t itemize deductions.

- For 2023, the maximum contribution for an individual is $3,850. If you are 55 or older, you are eligible for a catch-up contribution of $1,000.

- The maximum allowable contribution for family coverage is $7,750, plus $1,000 for those 55 and older.

- For 2024, the maximum contribution for an individual is $4,150. If you are 55 or older, you are eligible for a catch-up contribution of $1,000.

- The maximum allowable contribution for family coverage is $8,300, plus $1,000 for those 55 and older.

Tax-Deferred ‘Growth’

Using your Health Saving Accounts, you can invest your saving contributions in the market. Healthcare costs are highly inflationary, meaning prices consistently rise as time passes.

Given long-term historical market returns, investing in the stock market could help outpace the future and combat higher future medical costs during retirement.

Should you choose to use your HSA to invest in the market, any growth you may experience grows tax-deferred and will only be taxed once you take a distribution. Investments that can grow tax-deferred are allowed to use compounding because taxes are not being deducted annually.

Tax-Free Distributions

HSAs allow for tax-free distributions for Qualified Medical Expenses listed in IRS Publication 502. Some common household QMEs are many over-the-counter medicine prescriptions, and through the CARES Act of 2020, many OTCs are without a prescription. You’ll find a broad list of QMEs that apply to medical, dental, and vision.

If you take distributions from your HSA for non-QMEs, you will pay ordinary income tax on your distribution and an additional 20% penalty. Try to reframe the penalty encouragement to align your money with its purpose. The “penalty” encourages you to use your health care savings for their intended use and discourages misalignment.

Eligibility

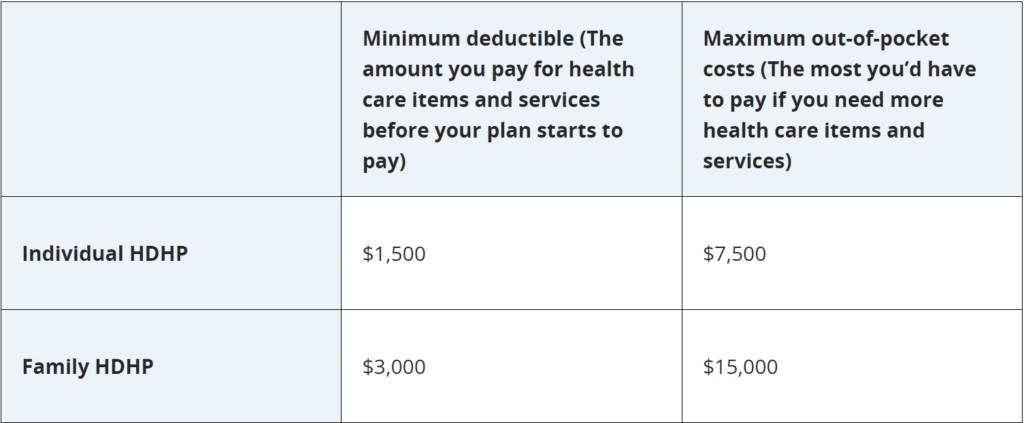

You must be enrolled in a High Deductible Health Plan (HDHP) to become eligible. HDHPs carry higher upfront expenses when you visit your medical providers. The deductible ranges are determined by tax law–2023 deductible ranges are in the table.

One HSA benefit is that your deductibles qualify as QMEs and can be paid with a tax-free distribution from your Health Savings Account.

Other eligibility requirements are:

- You are not covered by another health plan that is not an HDHP.

- You are not enrolled for Medicare benefits.

- You are not eligible to be claimed as a dependent on another individual’s tax return.

- You have HDHP coverage on the first day of the month the account is opened.

- Your annual limit is based on the number of months that you’re eligible for an HSA through an HDHP.

Differences Between HSA & FSA

One essential difference between a Health Savings Account and a Flexible Spending Account is the time allowance you can use the funds.

For an HSA, your funds are yours in perpetuity or year over year. FSAs are commonly known as ‘use it or lose it’ accounts meaning they are funded in the current year and, for the most part, must be used in the funded year, or the funds or forfeited–lost.

There are other differences between these two accounts, which we discuss in another blog, such as what expenses they cover.

More Advantages of Health Savings Accounts

During retirement, you want all supplement retirement income resources possible. One advantage of an HSA is that after you reach age 65, you can withdraw your funds without incurring a 20% penalty. However, you will incur ordinary income taxes–a distribution type mirroring a 401(k) or Traditional IRA.

Another advantage of HSAs is if you are in your younger years or can max fund your HSA and use funds outside your account to fund your real-time health care expenses, then your invested HSA funds can compound over time if you have the gift of both–fantastic. That said, don’t underestimate being able to use tax-free dollars in real time when you need them.

Benefits of Health Saving Accounts

An HSA can supercharge your pathway to financial freedom and security in your finances. The financial education in this blog is not advice. Consult your financial advice and tax professionals1,2.

Be sure to tune in and subscribe to the Life Money Balance® YouTube channel, blog, and follow our socials for more resources.